/imageserve/5f6eed43e4c891bdd9f2bf63/0x0.jpg)

Bitcoin and cryptocurrency trading is not for the faint of heart, as Dave Portnoy, the founder of the Barstool Sports blog-turned stock market day trader, learned this year.

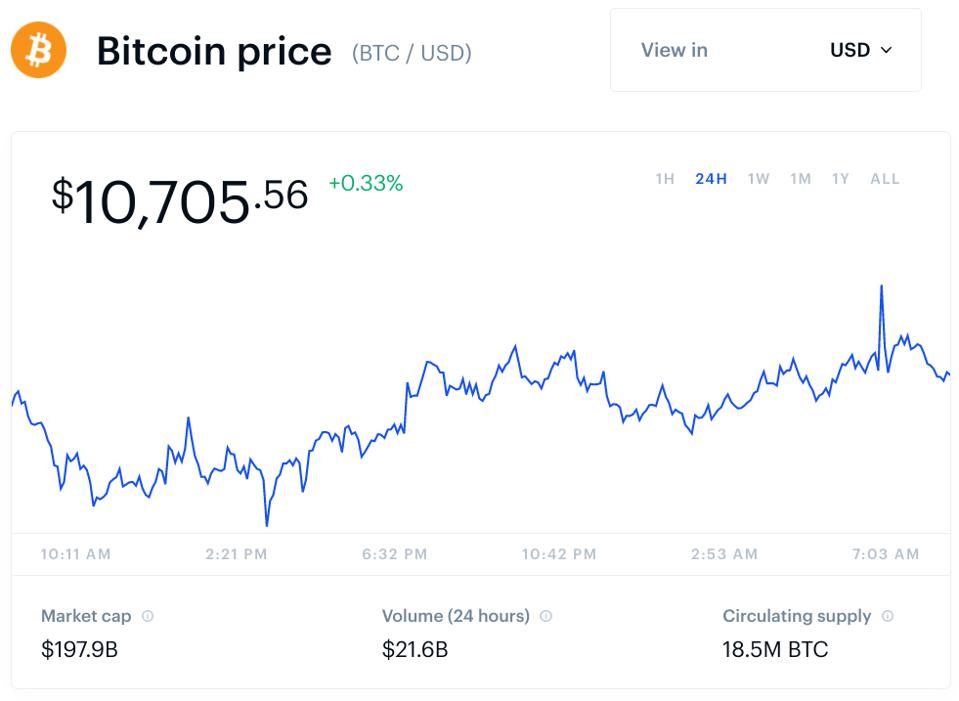

The bitcoin price, which has been bouncing around $10,000 per bitcoin since the beginning of September, has climbed through a tumultuous 2020—adding around 45%.

Now, Portnoy has revealed he’s completely cashed out his $1 million bet on bitcoin and warned he thinks the cryptocurrency market is nothing more than a Ponzi scheme.

The highly volatile bitcoin price has caused many high-profile investors to brand it a Ponzi scheme … [+]

“It’s just one big Ponzi scheme,” Portnoy told bitcoin and cryptocurrency investor Anthony Pompliano on the popular Pomp Podcast this week. “You get in, and you just have to not be the one left holding the bag. It’s no different from the stock market. Everyone’s pumping their own [coin], alright.”

Portnoy has found huge success riding the post-coronavirus crash stock market rally this year, buying discount shares that have soared amid unprecedented market intervention by the U.S. Federal Reserve—and leading an army of day traders with the maxim: Stocks only go up.

Portnoy jumped into the helter skelter world of bitcoin and cryptocurrencies over the summer, bowing to calls from his fans that he should branch out from stocks and shares. The whirlwind dalliance saw Portnoy buy some $1.25 million worth of bitcoin as well as the breakout Chainlink cryptocurrency before a downturn caused him to sell his holdings.

Following a Twitter declaration that he wanted to “buy all the bitcoins” in August, Portnoy invited cryptocurrency exchange founders Cameron and Tyler Winklevoss to explain bitcoin to him—which they did later that month with mixed success.

“I literally have no idea what bitcoin is,” Portnoy said after the Winklevoss twins’ interview.

The bitcoin price has been trading sideways through September after falling sharply at the end of … [+]

Despite selling his bitcoin and other cryptocurrency holdings, Portnoy did admit to Pompliano he misses the memes, adding that the bitcoin and cryptocurrency community is “kind of like my people.”

“I’ll get back,” Portnoy said. “I’ve been saying that I’ll be back into bitcoin. I don’t know when, but I’ll be back.”