/imageserve/5f9afef779b912317c118dc3/0x0.jpg)

With additional reporting from Jason Brett.

Changpeng Zhao, chief executive officer of Binance, exploded onto the cryptocurrency scene in 2017 with a new business model that rewarded customers with his company’s own cryptocurrency, then let them pay fees with the same currency.

Andrey Rudakov/Bloomberg

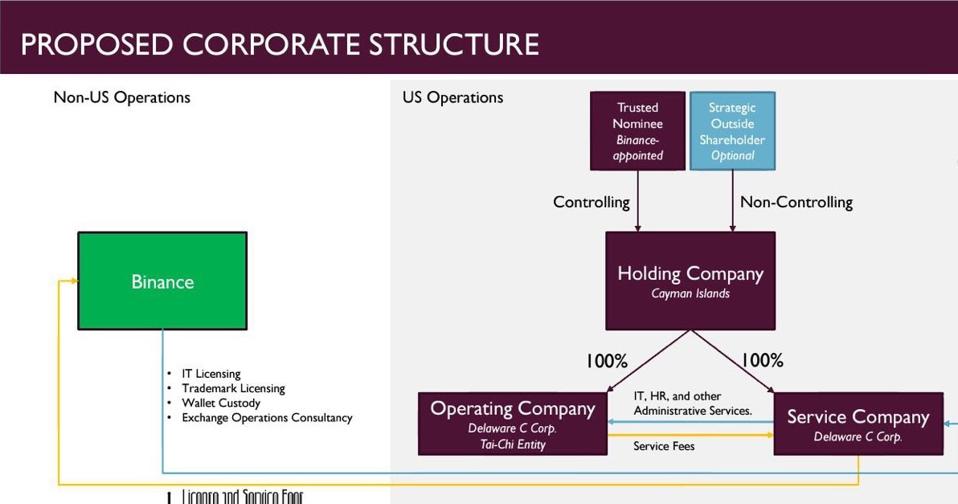

Binance Holdings Limited, the world’s largest cryptocurrency exchange conceived of an elaborate corporate structure designed to intentionally deceive regulators and surreptitiously profit from crypto investors in the United States, according to a document thought to be created by its senior executives and obtained by Forbes. Cayman Islands-based Binance is currently responsible for about $10 billion in total crypto trades per day and its founder and CEO Changpeng “CZ” Zhao is one of the few known cryptocurrency billionaires.

The 2018 document details plans for a yet-unnamed U.S. company dubbed the “Tai Chi entity,” in an allusion to the Chinese martial art whose approach is built around the principle of “yield and overcome,” or using an opponent’s own weight against him. While Binance appears to have gone out of its way to submit to U.S. regulations by establishing a compliant subsidary, Binance.US, an ulterior motive is now apparent. Unlike its creator Binance, Binance.US, which is open to American investors, does not allow highly leveraged crypto-derivatives trading, which is regulated in the U.S.

The leaked Tai Chi document, a slideshow believed to have been seen by senior Binance executives, is a strategic plan to execute a bait and switch. While the then-unnamed entity set up operations in the United States to distract regulators with feigned interest in compliance, measures would be put in place to move revenue in the form of licensing fees and more to the parent company, Binance. All the while, potential customers would be taught how to evade geographic restrictions while technological work-arounds were put in place.

Forbes reached out to founder CZ as well as its chief compliance officer Samuel Lim about the leaked document, but got no response. Binance.US CEO Catherine Coley also didn’t comment.

The source of the document, whose identity we’ve agreed not to reveal, says it was first presented to CZ in Q4 2018 by Binance mergers and acquisitions manager Jared Gross, an attorney who Forbes believes is actually the exchange’s general counsel. The source says the document was created by former Binance employee Harry Zhou, a serial entrepreneur, who is the co-founder of Koi Trading, a San Francisco-based cryptocurrency exchange partially owned by Binance. The file is named “Presentation 2” so there may have been other strategies being considered. Still, an analysis of the document reveals that many of the specifics outlined within it, are already in place.

One of the slides from the leaked slideshow, purporting to show how the “Tai-Chi Entity” could be connected to Binance.

Forbes

“U.S. Enforcement Mitigation”

The strategy document has four main components, Goals, Proposed Corporate Structure, Regulator Engagement Plans and Long Term License Plans. The first goal, enforcement mitigation, is designed to minimize the impact of U.S. regulation. It explicitly mentions the need to undermine the ability of “anti-money laundering and U.S. sanctions enforcement” to detect illicit activity. More specifically, it describes a detailed strategy for distracting the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) and Office of Foreign Assets Control (OFAC), the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the New York Department of Financial Services (NYDFS). To do this, the document advocates for participating in the U.S. Department of Homeland Security (DHS) Cornerstone Program for detecting weaknesses in the financial systems. A representative of the Department tells Forbes that Binance.US did participate in the Cornerstone program, as a standard part of the process of becoming a Money Service Business, but declined to comment further.

Interestingly, Binance itself is now a client of the DHS-funded CipherTrace, based in Menlo Park, California, one of the first security firms with technology explicitly designed to investigate on-chain transactions of the exchange’s own cryptocurrency. Another CipherTrace client is the U.S. Securities and Exchange Commission, which signed a one-year deal with CipherTrace this July.

While the SEC declined to comment as to whether or not its engagement of CipherTrace was part of a larger investigation into Binance or Binace.US, the contract explicitly states that one of the main reasons for selecting CipherTrace is it is “the only known blockchain forensics and risk intelligence tool that can support the Binance coin (BNB) and all tokens on the Binance network.”

“Insulate Binance from US enforcement”

The proposed corporate structure section starts off with a bold bullet point, “Key Binance Personnel continue to operate from non-U.S. location to avoid enforcement risks.” In the same section the document details how the Tai Chi entity would act as a magnet for regulatory inquiries, and should be willing “to accept nominal fines in exchange for enforcement forbearance.” Though not readily apparent, the document reveals that the Cayman Islands-based holding company will be connected to an unnamed Delaware C-corporation and the separate Tai Chi entity (see image above), showing how revenue from the U.S. business could be funneled back to Binance, the parent company. “License and service fees paid by the US Service company to Binance are functionally US-sourced trading fees,” the document states.

But unlike an actual subsidiary whose parent company could be held accountable for regulatory violations, the Tai Chi entity would have little more than a contractual relationship, further “insulat [ing] Binance from U.S. enforcement,” according to the document. Essentially, it would be a decoy.

The structure diagrammed in the 2018 document was initiated in August 2019 when Delaware-domiciled BAM (Binance America) Trading Services, was registered as a C-corp with an alternative name of Binance.US. The document describes how BAM Trading would license trading and wallet technology from Binance, but according to BAM Trading CEO Catherine Coley, there are no ownership ties to Changpeng Zhao’s Binance. While Coley confirms that CZ sits on her company’s board of directors, she declined to comment on who actually owned the company. “We don’t comment on ownership interests in BAM trading,” she says.

The 2018 document lays out a plan for its new subsidiary to be FinCEN compliant initially in at least 30 U.S. jurisdictions. Binance.US, registered as BAM Trading, has exceeded that goal and currently has a Money Service Business or MSB registered with FinCEN in 59 U.S. states and jurisdictions.

“…with no expectation of success.”

In a part of the leaked powerpoint labeled “Regulator Engagement Plans” it shows that Binance.US is expected to engage the Securities and Exchange Commission, the Commodities Futures Trading Commission and the New York Department of Financial Services, but importantly it explicitly notes that it doesn’t expect to gain approvals from any of them repeatedly using the phrase “with no expectation of success.”

In the case of the NYDFS, Binance (parent) did get permission to offer its U.S. dollar stablecoin to U.S. investors in 2019. However, the permission stopped short of a full BitLicense, which may just be part of the plan.

“Consider joining a self-regulatory organization…”

Other regulator engagement plans include joining crypto’s various self regulatory groups in an effort to “demonstrate compliance willingness.” Mentioned specifically is Tyler and Cameron Winklevoss’s Virtual Commodity Association, a self-regulatory group, but Binance.US, the Tai Chi entity, has not yet become a member. It has however joined several other non-profit trade associations, including DC-based Chamber of Digital Commerce and the Chicago Defi Alliance.

In August Binance.US joined the non-profit Blockchain Association, which describes itself as the “unified voice of the blockchain and cryptocurrency industry.” Almost immediately, Blockchain Association founding member Coinbase, a fierce competitor to Binance, resigned citing concerns over the organization’s credibility. While Coinbase never publicly mentioned Binance.US as the reason for its departure, a Coinbase representative confirmed that lax vetting prompted its exit from the association. Specifically, Coinbase has concerns that Binance.US did business with American investors prior to receiving its MSB license from FinCEN. The Blockchain Association responded to Coinbase’s departure with a tweet expressing regret at the loss, and emphasizing what it describes as “neutral membership criteria”

“Strategic treatment of VPN use at Binance to minimize economic impact”

Notably, the document explicitly calls for the “strategic” use of virtual private networks (VPNs) that obscure traders’ locations as a way to evade regulatory scrutiny by the SEC and the NYDFS. In addition to a guide to using VPN’s on Binance’s website, CZ has in multiple instances advocated for VPN use as a way to obscure a user’s location. In a June 2019 tweet he wrote that VPNs are “a necessity, not optional.”

“Bitcoin doesn’t have an office.”

Among crypto exchanges Binance is renowned for its execution speed, unique incentives and for its willingness to flout convention. Binance was founded in China in the summer of 2017 by Changpeng Zhao, 44, a cryptocurrency veteran with prior experience at bitcoin wallet provider Blockchain LLC and cryptocurrency exchange, OKCoin. Born in Jiangsu, China, CZ immigrated to Canada in the late 1980s after his professor father was accused of being a “pro-bourgeois intellect,” he told Forbes in 2018. After building a system for matching orders for high-speed traders on the Tokyo Stock Exchange and Bloomberg’s Tradebook, he founded Binance, using a similar interface. Like other crypto-exchanges, the company makes money by charging trading fees, margin interest fees, futures fees and deposit and withdrawal fees. Unlike other cryptocurrency exchanges though, Binance makes its own digital currency, the BNB coin.

Days before Binance officially launched in July 2017, the exchange raised about $15 million by selling BNB, which could in turn be used to pay fees, and was given away as an incentive for recommending new Binance traders. Binance’s novel approach, which is somewhat reminiscent of Amway-style multi-level marketing organizations, has created loyalty among its customers, and solved the nagging problems of retention experienced by many exchanges. The digital currency, whose float the company actively controls, is now worth $4.4 billion.

While the global market for spot trading cryptocurrency is rather easy to access, derivatives, where investors can leverage their investment by as much as 125X, are highly regulated in the U.S. and elsewhere, with few reputable competitors. Traders flock to Binance, in part because of the leverage they can employ. Binance’s unique crypto-exchange model has been a huge success, especially in Asia. Its growth has been so rapid that only a year after launch, CZ was listed among the Forbes richest in crypto with an estimated wealth of between $1.1 and $2 billion.

Parent company, Binance is currently known to be Cayman Islands based but the exchange first launched in Shanghai. Later as the Chinese government cracked down on cryptocurrency trading, the company moved its headquarters to Japan and then Malta. In May 2020 CZ told former Forbes staffer Laura Shin that Binance’s headquarters were wherever he was. His answer wasn’t necessarily evasive but presented as a rally cry for blockchain’s ideals of decentralized power. “I think what this is is the beauty of the blockchain,” he said. “Like where’s the Bitcoin office? Because Bitcoin doesn’t have an office.”

Last April Binance launched a distributed exchange, or DEX, that purports to directly connect counterparties in a trade without the direct involvement of Binance or any other middleman. The exchange is built directly on Binance’s own blockchain called ‘Binance Smart Chain’, similar to bitcoin, and therefore more difficult—or impossible—to shut down. Think of it as plumbing owned by no one and everyone. Because the exchange is built on the public blockchain, American investors, or anyone else, can use it without disclosing their location or personally identifiable information. DEX, currently in its infancy, is now transacting $340,000 a day.

Though Binance prohibits U.S. residents from trading on its main exchange, many already are customers, side-stepping the “geo-fencing” restrictions currently in place. Instructions for how to do so are widely available, including a post on industry news site CoinDesk. The exchange’s popularity among Americans prompted the creation of more compliant Binance.US, aka the Tai Chi entity, in September 2019. More than a year after its launch it is now trading a pitiful $18.7 million in daily crypto volume—perhaps just enough to be a distraction to regulators. By contrast, parent Binance trades $2.7 billion a day in cryptocurrency spot trades per day and $7.7 billion a day in derivatives, according to CoinGecko. The largest U.S. competitor, Coinbase Pro, trades $449 million in daily spot volume.

Fueling the idea that Binance has been side-stepping American regulators, in September, Japanese exchange Fisco filed a lawsuit in the Northern District of California alleging that Binance was the go-to location for “the laundering of stolen cryptocurrency.” To establish jurisdiction in the region, the suit asserts that the off-line computers Binance uses to store much of its cryptocurrency are in California, and that the Amazon servers the exchange uses for its cloud storage are also based in the state. Binance has not responded to our request for comment on the case. On the same day the case was filed, the self-regulatory Financial Action Task Force (FATF), published a report highlighting that the practice of frequently changing headquarters was a key “red flag” characteristic of money laundering.

The alleged author of the Tai Chi document, Harry Zhou, is known for his experience launching American versions of Chinese companies. In 2018, Zhou worked as the general counsel at HBUS, the American arm of Huobi, another Chinese cryptocurrency exchange that set up a compliant shop in the U.S. HBUS has since closed. Zhou is the co-founder of Koi Trading Systems, founded in August 2018 and backed by $3 million from Binance’s venture capital arm. Binance says Zhou is no longer an employee however initial documents for Binance.US list Koi Trading as sharing its address.

Forbes has learned that the Tai Chi document is currently circulating among law firms, accounting firms and others associated with Binance, and there is speculation that the FBI and the IRS may be investigating. When reached by telephone, an FBI agent in the Washington, D.C .field office initially denied knowledge of Binance and hung up. Later, the agent formally issued a “no comment.”

The questions swirling around Binance could hardly come at a worse time. With bitcoin in the midst of a bull run that has surpassed year-to-date gains of Apple, Amazon, Google and Facebook, news questioning the credibility of the world’s largest crypto-currency exchange will be unwelcome by traders. Earlier this month four senior executives of exchange giant BitMEX were indicted by the U.S. Department of Justice for allegedly violating the Bank Secrecy Act. In another case crypto-exchange OKEx briefly shut down operations after it lost touch with an executive said to be cooperating with a Chinese government investigation. All those charged at BitMEX have stepped away from daily duties. Co-founder Ben Delo says he will “defend himself against these allegations vigorously.” BitMEX released a statement saying “we strongly disagree with the U.S. government’s heavy-handed decision to bring these charges, and intend to defend the allegations vigorously.”

So far, Binance.US has been a paragon of corporate American citizenship, both playing nice with regulators, and winning a shining reputation with a series of philanthropic ventures, not the least of which was Crypto Against Covid that raised almost $5 million to fight the Covid-19 pandemic. Binance and Binance.US are two of only five exchanges to win the highest rating on CoinGecko’s new Trust Score that measures the reliability of an exchange’s reported trading volume.

As for the Tai Chi document, perhaps the most important objective set out in the strategic plan is a directive inserted at the bottom of one of the pages. It says that eventually the entity should be consumed by its creator: “Binance to acquire the US operation at a nominal price and rearrange its leadership when it has served its purposes.” Thus “overcoming,” fulfilling the second principle of the ancient martial art.