/imageserve/5f70a75c343da38d2c879079/0x0.jpg)

Get Forbes’ top crypto and blockchain stories delivered to your inbox every week for the latest news on bitcoin, other major cryptocurrencies and enterprise blockchain adoption.

(Photo by studioEAST/Getty Images)

CRYPTO MARKETS

Bitcoin slumped with the stock market Monday, falling more than 5%, after miners began selling at a higher rate on Sunday. Ether cooled off as well, and the average DeFi token has slumped 30% to 40% in recent weeks.

Bitcoin showed more strength later in the week with 4% gains Thursday. Guy Hirsch, an executive at crypto trading firm eToro, expects uncertainty about the upcoming U.S. election and heightened political tensions to be a boon for bitcoin.

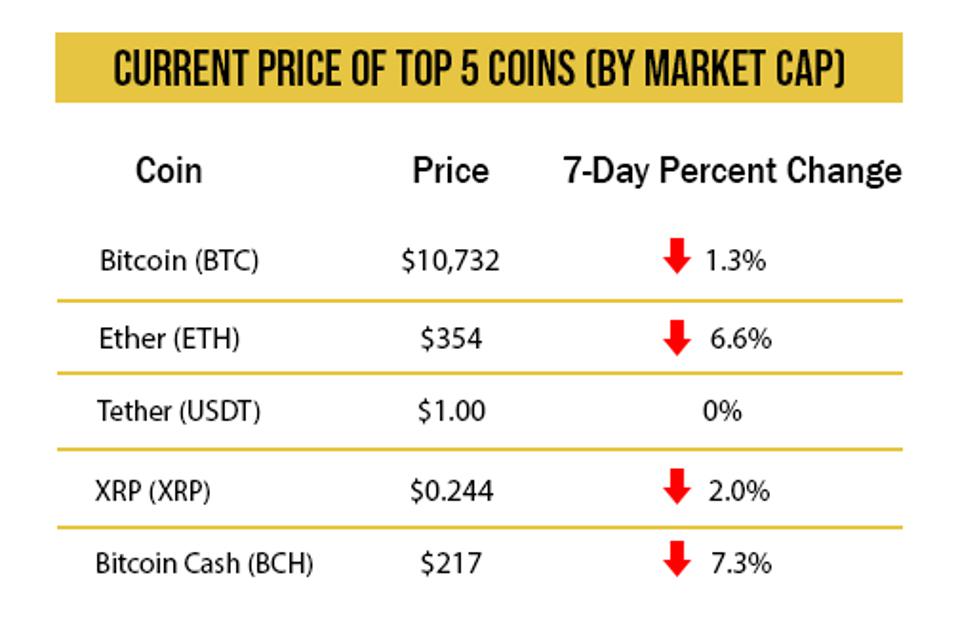

Source: Messari. Prices as of 4:00 p.m. on September 25, 2020.

DIGITAL DOLLAR PROGRESS

The Office of the Comptroller of the Currency issued another letter opening the door for more banks to be accommodating to the crypto industry. It’s now allowing U.S. financial institutions to hold deposits as reserves for stablecoins pegged to the U.S. dollar. Under acting comptroller Brian Brooks, a former Coinbase executive, the OCC first expressed more lenience to crypto with a letter permitting cryptocurrency custodial services in July.

VISA

V

’S CRYPTO PLANS

Two Visa executives made it clear in an exclusive interview that digital assets and blockchain technology will be important parts of the credit giant’s future. Head of fintech Terry Angelos and head of crypto Cuy Sheffield covered Visa’s partnership with Coinbase, its withdrawal from Facebook’s Libra Association, its recent blog post about its approach to digital currency and much more.

DEFI COMPETITION

The proliferation of DeFi assets has created new opportunities as well as new problems on the Ethereum blockchain. In order to initiate any activity on the blockchain, users need to pay a fee for the unit of activity, called gas, and those fees have risen by a factor of more than 20 this year as activity has surged. The inflation is disrupting preexisting business that aren’t DeFi models and has priced out experimentation, critics say.

But DeFi appears to be here to stay, and crypto exchange OKCoin listed three more tokens this week, part of its announcement earlier this month that it would explore listing up to 18 new assets. Bitcoin is even starting to get into the craze, with some investors converting it to tokenized bitcoin to access DeFi markets.

HOW NORWAY OWNS BITCOIN

With business intelligence firm MicroStrategy

INFLATION IMPLICATIONS

Both the Fed and the European Central Bank are now racing to try to generate more inflation and revitalize consumer spending amid the current economic downturn, a dynamic that could lend long-term support to cryptocurrencies. Even for risk-averse institutions trying to hedge their portfolios, a 1% allocation could have a significant impact.

The emerging sovereign debt crisis is also beginning to accelerate, with more than 100 countries owing $130 billion in debt interest this year. Covid-19 has pushed economies to the brink across the globe, offering a potential new reason for more widespread cryptocurrency adoptions.

ELSEWHERE

The EU announces its first ever plan to regulate cryptocurrencies [CNBC]

Winklevoss Twins’ Crypto Exchange Is Expanding Into the U.K. [Bloomberg]

The Currency Cold War: Four Scenarios [CoinDesk]