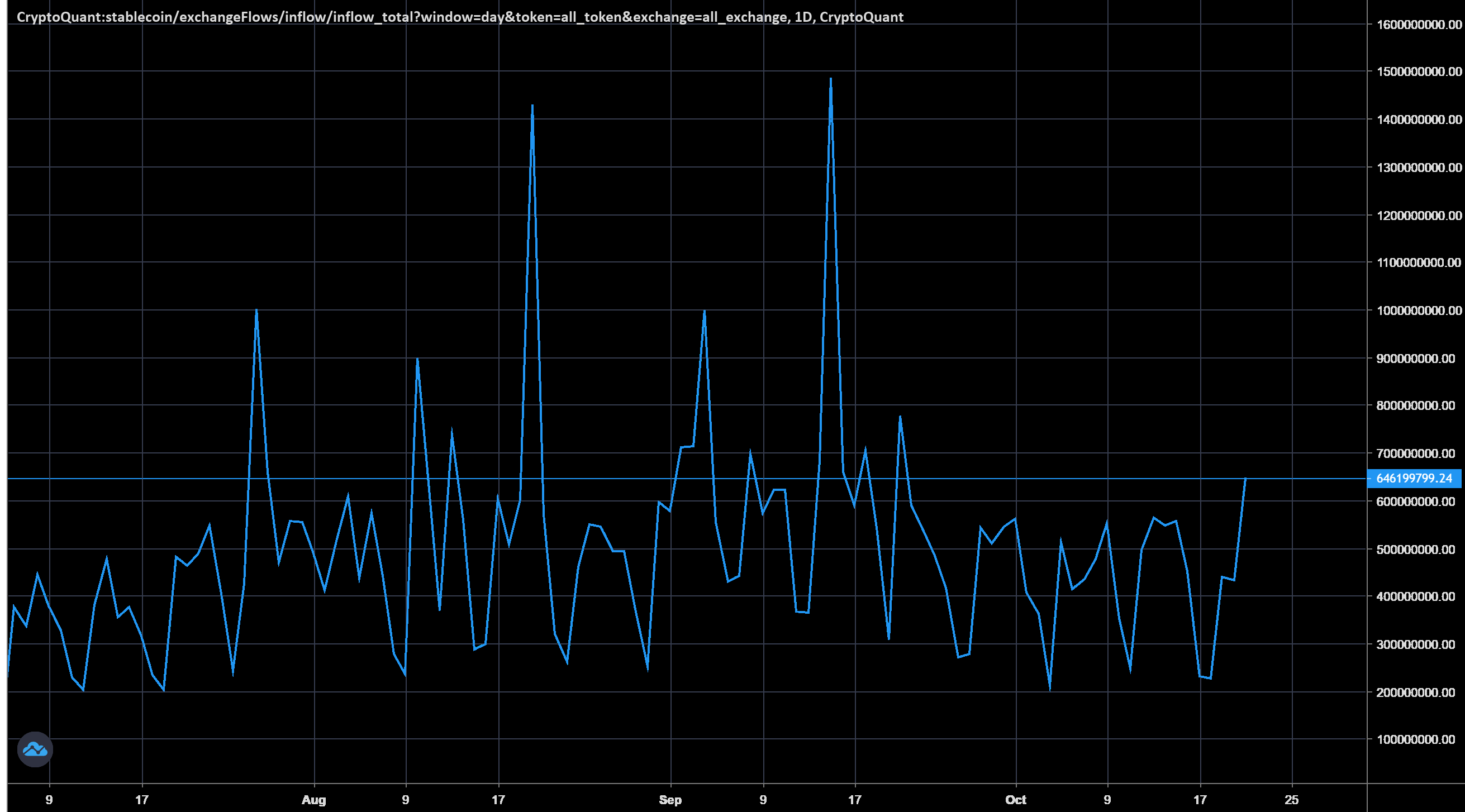

In the days preceding Bitcoin’s latest rise in price, stablecoins went wild, exhibiting some largely unprecedented behavior.

On October 18, stablecoins moving to exchanges reached record highs of 60,000 and 56,000 respectively, according to data from CryptoQuant. The outlet’s data tracked USDT on Ethereum, PAX, USDC, TUSD, DAI, SAI, BUSD, HUSD and USDK. When it comes to the total inflow of all stablecoins in terms of the dollar value, no extraordinary trends were detected.

CryptoQuant CEO Ki Young Ju told Cointelegraph that, although the inflows were not huge in terms of dollar value, they signified a bullish trend among retail investors:

“Depositing from more retail investors usually means the market sentiment is turning into bullish.”

Ju believes that the market’s high address and transaction count indicates that inflows were coming from a large number of retail investors rather than from a few large players. The assumption is that investors send stablecoins to exchanges when they plan to convert them to other crypto assets — primarily Bitcoin. Yesterday, Tether minted 450 million USDT on the Tron (TRX) network. The company’s CTO Paolo Ardoino clarified earlier that the amount was authorized, but not issued:

“PSA: 300M USDt inventory replenish on Tron Network. Note this is a authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests.”

Tether’s market capitalization quadrupled in 2020, beginning the year with $4 billion and rising to $16 billion at time of publication. Meanwhile, Bitcoin balances on major exchanges fell below 2.5 BTC for the first time in years.