Bitcoin was gaining amid positive institutional and retail adoption signs as the amount of crypto locked in Uniswap signals DeFi continues to be more just than a fad.

- Bitcoin (BTC) trading around $16,154 as of 21:00 UTC (4 p.m. ET). Gaining 2.9% over the previous 24 hours.

- Bitcoin’s 24-hour range: $15,454-$16,186

- BTC above its 10-day and 50-day moving averages, a bullish signal for market technicians.

Bitcoin was trending upward Thursday, continuing a direction that started Wednesday. The price per 1 BTC was able to hit as high as $16,186, according to CoinDesk 20 data. However, Guy Hirsch, managing director for U.S. at multi-asset brokerage eToro, cautions choppy waters might be ahead.

“Bitcoin’s struggle to consolidate above the $16,000 price level can likely be attributed to a number of factors including profit taking and capital rotation into some of the small-cap digital assets that have been recently surging,” Hirsch said. “If bitcoin can establish a base in the low-$16,000 range, there isn’t much resistance on the path to $17,000 and beyond.”

Jason Lau, chief operating officer of San Francisco-based cryptocurrency exchange OKCoin, echoed the sentiment.

“Bitcoin cleared $16,000 for the first time in three years, confirming the existing bullish uptrend,” Lau said. “With minimal resistance until $20,000, it’s hard to tell how the next few weeks will trade into year end, but signs are positive.”

Powerfully positive fundamentals in both institutional and retail adoption has Lau bullish.

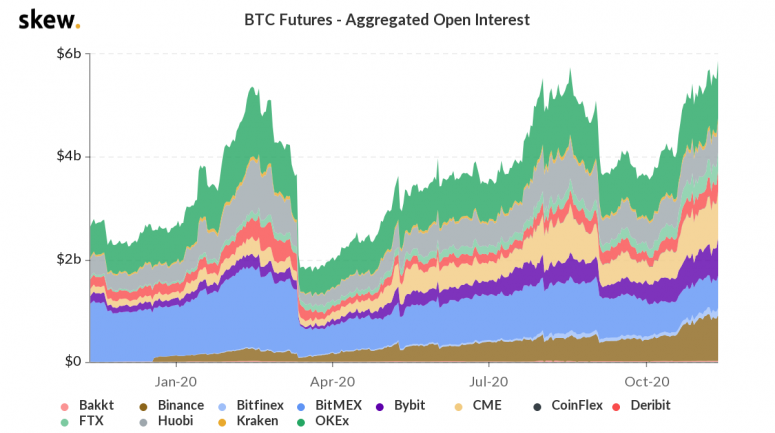

“Strong institutional interest – BTC futures open interest is at all-time highs – and incoming retail flow – PayPal opened up crypto buys to all U.S. users today – is providing continued fuel for this rally,” Lau told CoinDesk.

Bitcoin futures open interest crossed $8 billion on major venues Wednesday, the highest data aggregator Skew has on record.

“Aggregate bitcoin futures open interest continues to rise and, more importantly, it is not just the unregulated venues that are seeing this growth but also [open interest] on the CME is within touching distance of the $1 billion mark,” noted Denis Vinokourov, head of research at crypto brokerage Bequant. Total CME open interest for Wednesday was $912 million, according to Skew.

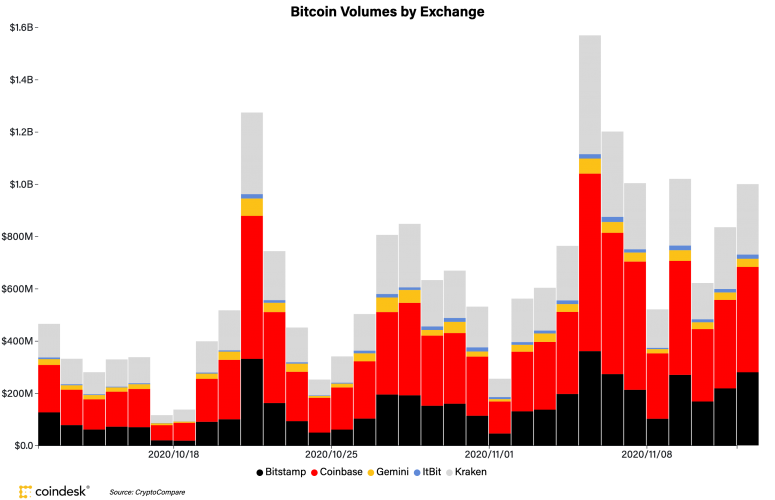

Spot bitcoin volume has also been strong Thursday. It was close to $1 billion as of press time, much higher than the past month’s $378 million average daily volume.

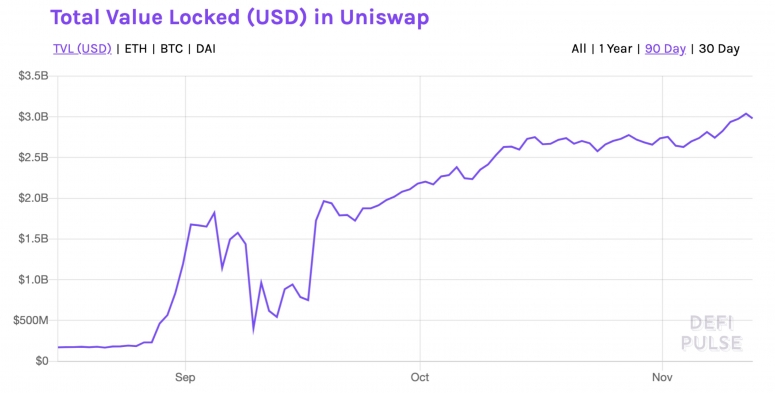

Another trend to watch: How decentralized exchanges (DEXs) and decentralized finance (DeFi) impact the bitcoin market during this price surge. “The bulls are in charge of this trend and, as the old saying goes, do not fight the trend,” said Bequant’s Vinokourov. “With top DEX/DeFi venues such as Uniswap and Sushi trading cheap on price/sales ratio, it would not be surprising for them to lead to another wave of capital inflow into small- and mid-cap assets.” A price/sales ratio is common in valuing stocks, and a low ratio generally indicates a good buy.

“Large-cap assets (such as bitcoin) may be leading the charge now, but that will not stop the hunt for yield trade,” Vinokourov added.

Uniswap crosses $3 billion locked

Ether (ETH), the second-largest cryptocurrency by market capitalization, was down Thursday, trading around $458 and slipping 1.6% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

The amount of cryptocurrency “locked” in the DEX Uniswap crossed $3 billion Wednesday. Crypto investors place assets in smart contracts such as Uniswap’s to provide liquidity and, in turn, gain profits, or yield, for doing so in the form of the fees traders pay to use the DEX’s liquidity.

The total locked slipped a bit Thursday but was still hovering around $3 billion as of press time. Brian Mosoff, chief executive officer of investment firm Ether Capital, said this metric shows that despite some calling DeFi a fad, it’s here to stay.

“Many skeptics from traditional finance and the crypto community were quick to attribute the summer high trade volume on Uniswap to nothing more than yield farming and pump and dumps,” Mosoff told CoinDesk. “Now that much of that activity has simmered, Uniswap crossing this new milestone is further proof that DeFi and [automated market makers] are here to stay.”

Other markets

Digital assets on the CoinDesk 20 are red Thursday. Notable losers as of 21:00 UTC (4:00 p.m. ET):

- Oil was down 1.1%. Price per barrel of West Texas Intermediate crude: $40.92.

- Gold was in the green 0.54% and at $1,875 as of press time.

- The 10-year U.S. Treasury bond yield fell Thursday dipping to 0.883 and in the red 10.2%.