InvestorPlace

7 Robinhood Stocks to Buy As the Trading Platform Expands

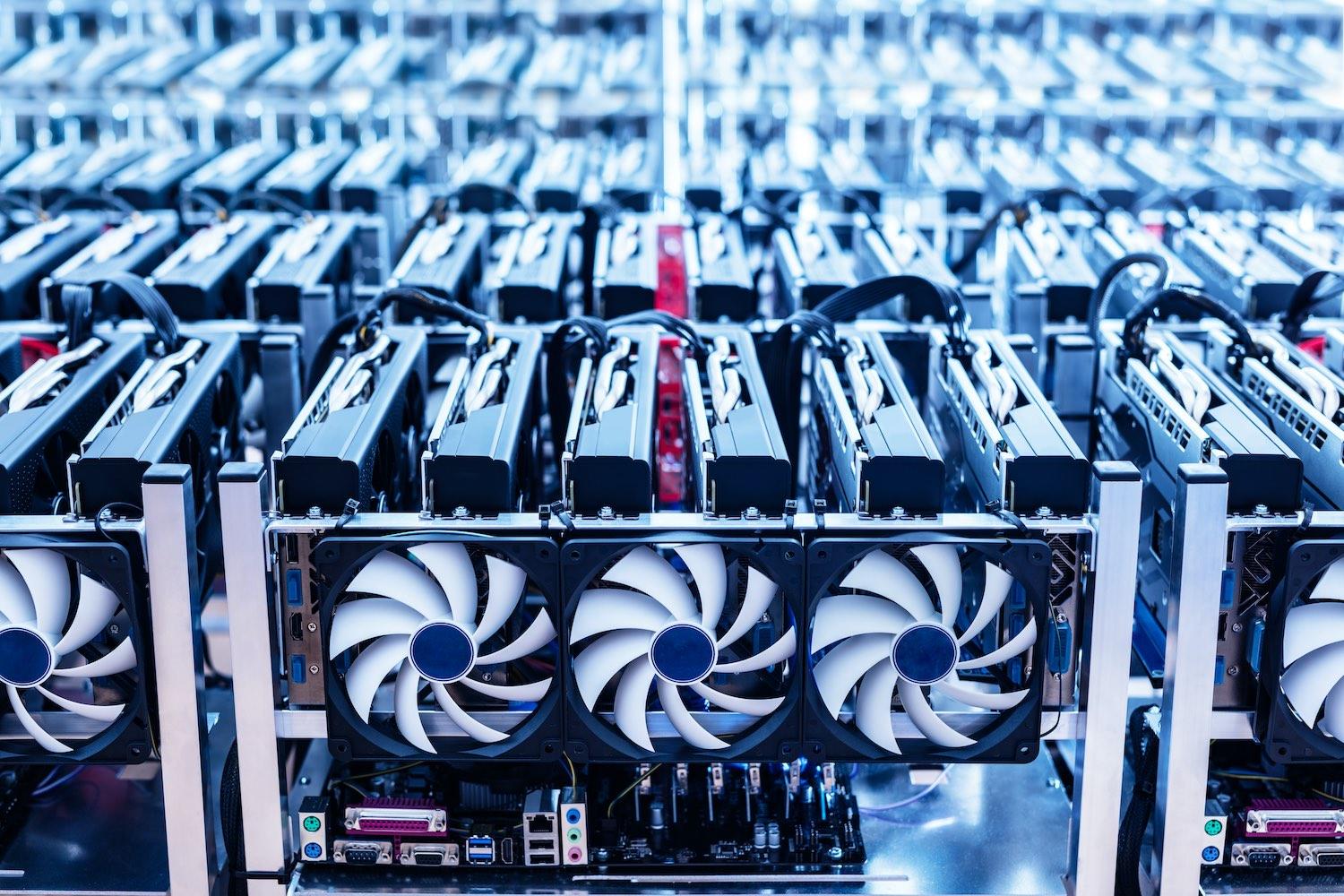

Online broker Robinhood has changed the game for retail investing by making it easier for investors to participate in the stock market. Launched in 2015, its trading app has gained considerable popularity since the onset of the pandemic, launching several Robinhood stocks to buy higher as the platform expands. Recent research by Michael S.Pagano of Villanova University, Pennsylvania, concludes, “Using data on stocks held by individual investors at retail brokerage firm Robinhood, we document that these investors are actively engaged in both momentum and contrarian trading strategies.” The broker is well-known for offering “free” trades, but it generates income via payment for order flow. Essentially, when a person trades on the app, Robinhood sends that trade to a larger entity, which is able to leverage thousands of orders at once for a slight advantage. The larger entity then compensates Robinhood for the orders.” In addition to this payment-for-order flow structure, the broker earns revenue through margin fees and cash balance interest.InvestorPlace - Stock Market News, Stock Advice & Trading Tips 8 Stocks to Buy for March Robinhood is likely to keep making headlines in 2021 as retail investors move their capital to the platform. With that information, here are seven Robinhood stocks to watch in the coming months: Global X Lithium & Battery Tech ETF (NYSEARCA:LIT) Nvidia (NASDAQ:NVDA) Plug Power (NASDAQ:PLUG) Starbucks (NASDAQ:SBUX) Tilray (NASDAQ:TLRY) Uber Technologies (NYSE:UBER) Zoom Video Communications (NASDAQ:ZM) Market volatility and increased retail interest in investing and trading has seen Robinhood’s business increase significantly. Earlier in February, the company announced that it raised $3.4 billion in funding. Its valuation is fast approaching $40 billion. The gamechanger is here to stay. Robinhood Stocks to Buy: Global X Lithium & Battery Tech ETF (LIT) Source: Olivier Le Moal/ShutterStock.com 52-Week Range: $17.83 – $74.83 1 year % change: Up about 95% Dividend Yield: 0.38% Total Expense Ratio: 0.75% The Global X Lithium & Battery Tech ETF invests in business that focus on the full lithium supply chain, i.e. from mining and refining the metal all the way to battery production. LIT, which tracks the Solactive Global Lithium Index, has 40 stock holdings and since its inception in July 2010, net assets have reached $3 billion. 2020 saw immense consumer and investor interest in electric vehicles (EV) and alternative energy sources. As lithium is preferred over lead-acid batteries, lithium stocks have benefited significantly in the past year. For instance: “Charging a lead-acid battery can take more than 10 hours, whereas lithium ion batteries can take from 3 hours to as little as a few minutes to charge, depending on the size of the battery.” As far as sectors are concerned, funds are distributed among Materials (42.7%), Industrials (28.5 %), Consumer Discretionary (16.3%) and Information Technology (11.3%), among others. Over 60% of the holdings are in the top ten stocks. Chinese firms comprise 43.9% of the holdings, followed by stocks from the U.S. (21.8%), South Korea (12.0%), Japan (6.6%) and others. Leading names in the fund are Albemarle (NYSE:ALB), Ganfeng Lithium (OTCMKTS:GNENF), Byd (OTCMKTS:BYODY), Samsung and Eve Energy. Given the significant increase in price, LIT is likely to come under pressure in the coming weeks. However, buy-and-hold investors should regards dips in price as opportunity the into the fund. Nvidia (NVDA) Source: Steve Lagreca / Shutterstock.com 52-week range: $180.68 – $614.90 1-year price change: Up about 92% Dividend yield: 0.11% California-based chip darling Nvidia focuses on personal computer (PC) graphics, graphics processing units (GPUs) and artificial intelligence (AI). The group operates through two segments: GPU and Tegra Processor. Its GPU product brands are aimed at specialized markets, including GeForce for gamers; Quadro for designers; Tesla and DGX for AI and big data researchers; and GRID for cloud-based visual computing users. Put another way, the company has a strong product portfolio, which has been the catalyst behind the recent sales growth. Nvidia reported record revenue of $4.73 billion for the third quarter, up 57% from $3.01 billion a year earlier. Non-GAAP net income was $1.83 billion, a 66% increase YoY. Non-GAAP earnings per diluted share were $2.91, up 63% from $1.78 a year earlier. Free cash flow was $806 million, down 48% YoY. CEO Jensen Huang said: “NVIDIA is firing on all cylinders, achieving record revenues in Gaming, Data Center and overall. We are continuing to raise the bar with NVIDIA AI. We swept the industry AI inference benchmark, and our customers are moving some of the world’s most popular AI services into production, powered by NVIDIA technology.” 8 Stocks to Buy for March NVDA stock’s forward P/E and P/S ratios are 48.08 and 22.98, respectively, pointing to a frothy valuation level. A potential decline toward the $525 level would improve the margin of safety. The work from home trend may take a breather as the economy opens up further. Yet, Nvidia remains one of the most important chip names that belong in a growth portfolio. Plug Power (PLUG) Source: Halfpoint/ShutterStock.com 52-week range: $2.43 – $67.00 1-year price change: Up 57.81% Plug Power develops hydrogen fuel cell systems for the industrial market. Recent months have seen increasing enthusiasm for hydrogen as “a clean fuel that, when consumed in a fuel cell, produces only water, electricity and heat. Hydrogen and fuel cells can play an important role in our national energy strategy, with the potential for use in a broad range of applications, across virtually all sectors — transportation, commercial, industrial, residential, and portable.” An important part of Plug Power’s revenue comes from selling fuel-cells for forklifts used in warehouses by retail giants Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT). According to the most recent quarterly results, net revenue was $83.5 million, compared to $38.9 million a year ago. GAAP net loss increased to $39.4 million, compared to $18.1 million in Q3 2019. GAAP net loss per share came at 11 cents. A year prior, it was 8 cents. Cash and equivalents were $731.4 million, compared to $198.3 million a year earlier. CEO Andy Marsh said, “I’d like to highlight our operational performance. Company achieved $126 million in gross billings. This represents 106% increase from the third quarter of 2019. This quarter is a strong validation of our business model in years to come.” PLUG stock’s P/B and P/S ratios are 42.09 and 49.50, respectively. In the case of short-term profit-taking, buy-and-hold investors might find better value around $42.50. The company hopes to achieve $1.2 billion in annual sales by 2024. Although that is an ambitious number that might prove difficult to reach in a couple of years, Plug Power has long-term tailwinds to support the share price. Starbucks (SBUX) Source: monticello / Shutterstock.com 52-week range: $50.02 – $107.75 1-year price change: Up about 16% Dividend yield: 1.78% Specialty-coffee retailer Starbucks needs little introduction. SBUX serves customers with its company-owned and licensed locations, both in the U.S. and worldwide. However store closures due to the pandemic have negatively affected foot traffic and sales. In late January, Starbucks’s released Q1 earnings. Revenue was $6.7 billion, showing a 5% YoY decrease. Management mainly pointed the finger at Covid-19 for the decline. On the other and, analysts were pleased that the group opened 278 net new stores in Q1 FY21, a 4% YoY unit growth. Earnings came at $622.2 million, a 29.8% drop from the prior year. Non-GAAP earnings per share fell from 79 cents to 61 cents. CEO Kevin Johnson cited, “Investments in our partners, beverage innovation and digital customer relationships continued to fuel our recovery and position Starbucks for long-term, sustainable growth.” 8 Stocks to Buy for March SBUX stock’s forward price-earnings and price-sales ratios are at 36.4 and 4.12, respectively. As economies worldwide continue to open up, I expect Starbucks to get back its customers and sales to rebound. Long-term investors could buy the dips. Tilray (TLRY) Source: Jarretera / Shutterstock.com 52-week range: $2.43 – $67.00 1-year price change: Up about 36% Dividend yield: N/A Canada-headquartered cannabis producer Tilray has been making headlines in recent weeks. In mid-December, the group announced an upcoming merger with another Canadian pot marijuana business, Aphria (NASDAQ:APHA). The combined entity will become the largest pot company in the world, based on pro forma revenue. Following the news TLRY stock hit a 52-week high of $67 in February. However since then, profit-taking has kicked it and shares are now around $26. Tilray announced Q4 and 2020 year end financial results on Feb. 17. Accordingly, total revenue increased to $56.6 million, up 20.5% compared to the fourth quarter of 2019. Net loss was $3.0 million, or 2 cents per share. A year ago, the comparable numbers were a net loss of $219.8 million and losses of $2.14 per share. Although the metrics showed increased revenue in the company’s cannabis segment, analysts concur that neither the Canadian recreational/adult segment nor the international or Canadian medical segments are large enough to provide further sustained support to the stock price. In fact, investors decided to hit the “sell” button following the results. After the U.S. Presidential election in November, pot stocks took center stage, contributing to the rapid rise in price. Now volatility seems to be back for the sector as the market wonders whether U.S. legalization is indeed in the cards soon. Therefore, we are likely to see wild price swings in most marijuana names, including TLRY stock. Interested investors should regard declines toward $20 or below as better entry points. Uber Technologies (UBER) Source: NYCStock / Shutterstock.com 52-week range: $13.71 – $64.05 1-year price change: Up about 37% San Francisco, California-based Uber’s platform matches carriers with customers to move people, food and things through cities, both stateside and overseas. The platform is best known for its Uber ride-hailing app, but despite the declines in taxi rides during the pandemic, Uber’s food delivery business was a bright star for the company’s bottom line. According to quarterly metrics announced on Feb. 20, Q4 revenue was $ 3.2 billion, down 16% YoY. Net loss was $968 million, an improvement of 12% compared the loss of $1.09 million a year ago. Net loss included $236 million in stock-based compensation expense. Diluted loss per share was 54 cents. CEO Dara Khosrowshahi cited, “While 2020 certainly tested our resilience, it also dramatically accelerated our capabilities in local commerce, with our Delivery business more than doubling over the year to a nearly $44 billion annual bookings run-rate in December.” 8 Stocks to Buy for March UBER stock’s P/S and P/B ratios are 9.19 and 8.81, respectively. As economies start going back to “normal,” Uber could potentially see considerable upside in the coming quarters, especially in its ridesharing operations. Zoom Video Communications (ZM) Source: Michael Vi / Shutterstock.com 52-week range: $97.02 – $588.84 1-year price change: Up about 280% Zoom, founded in 2011, has become one of the most important stocks of 2020. The San Jose, California-based group provides a video communications platform that has become an instant hit in recent months. It announced its Q3 results on Dec.1. Revenue was $777.2 million, up 367% YoY. Non-GAAP net income was $297 million as compared to $25 million a year ago. The income translated into 99 cents per share vs. 9 cents of diluted EPS in Q3 2019. Free cash flow stood at $388 million. CEO Eric S. Yuan commented, “We finish the fiscal year with an increased total revenue outlook of approximately $2.575 billion to $2.580 billion for fiscal year 2021, or approximately 314% increase YoY.” According to management’s guidance, full fiscal year 2021 non-GAAP diluted EPS is expected to be $2.89 to $2.91. Zoom will release its fourth quarter and full year results for fiscal year 2020 in early March. ZM stock’s forward P/E and P/S ratios are 131.33 and 63.09, respectively, showing an expensive valuation. Potential long-term investors could consider investing in the videoconferencing king around $375 or lower. On the date of publication, Tezcan Gecgil is both long and short Zoom stock. Tezcan Gecgil has worked in investment management for over two decades in the U.S. and U.K. In addition to formal higher education in the field, she has also completed all 3 levels of the Chartered Market Technician (CMT) examination. Her passion is for options trading based on technical analysis of fundamentally strong companies. She especially enjoys setting up weekly covered calls for income generation. More From InvestorPlace Why Everyone Is Investing in 5G All WRONG Top Stock Picker Reveals His Next Potential Winner It doesn’t matter if you have $500 in savings or $5 million. Do this now. #1 Play to Profit from Biden’s Presidency The post 7 Robinhood Stocks to Buy As the Trading Platform Expands appeared first on InvestorPlace.